NEWS

SURVEY: 41% CHINESE CONSUMERS DRANK LESS OR NO ALCOHOL DURING VIRUS OUTBREAK

By Tony Zhu

21-4-2020

Credit: Kian Zhang/Unsplash

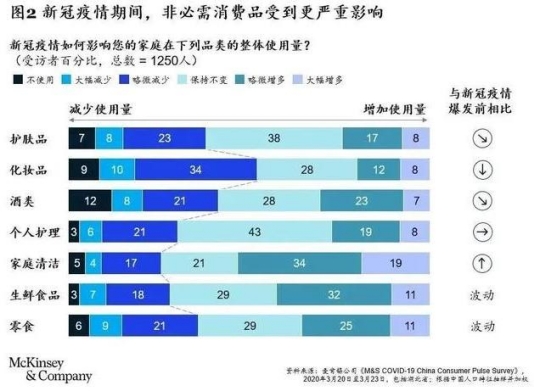

A consumer survey conducted by management consultancy company McKinsey showed that 41% of Chinese consumers had consumed less or refrained from alcohol during COVID-19 crisis while 29% said they had consumed more.

The company has surveyed a total of 2,500 Chinese consumers in two rounds of interviews conducted in 21 - 24 February and 20 - 23 March.

The survey aimed at gauging consumer attitudes across eight product categories: alcohol, makeup, skincare, snacks, home cleaning, personal care, fresh food and baby care during and after the COVID -19 crisis.

On consumption of alcohol, it was found that 12% respondents said they had not consumed any alcohol during the outbreak in China, 21% said they had consumed slightly less while 8% said they had consumed a lot less.

At the same time, 28% said their alcohol consumption remained the same, while 23% said they had consumed slightly more and 7% said they had consumed a lot more.

Demands for non-essential goods more affected, alcohol category shown on 3rd row from top

Source: Mckinsey & Company

Across all the eight categories, when asked how they expect their consumption to evolve following the crisis, the majority said they will revert to pre-crisis levels, with 60 to 70% expecting to resume normal consumption or consume slightly more, and another 10% said they will consume a lot more, perhaps reflecting a degree of deferred demand.

Between 20 and 30% of respondents suggested they will continue to be cautious, either consuming slightly less or, in a few cases, a lot less across the eight consumer goods categories.

The report also said that respondents in higher-tier cities like Beijing and Shanghai tend to be more positive, with around 55% saying they are optimistic, compared with around 40% in lower-tier cities in the less developed parts of China.

The survey also found that more than 70% respondents had spent more time browsing products online with Key Opinion Leaders (KOLs) the most popular form of engagement.

It said online platforms generated a 15 to 30 percentage-point incremental share of purchases across the categories.

It also said local brands tended to react fastest in the online space, reflecting digital capabilities that are often more matured than those of international brands.

Many local brands were said to have leveraged their established social commerce infrastructure and social platforms, and in particular live-streaming capabilities.

(the writer can be contacted at: info@thewinechronicle.com)

ALL RIGHTS RESERVED

**IF YOU THINK THE WINE CHRONICLE IS WORTH SUPPORTING, PLEASE MAKE A DONATION TO HELP US IMPROVE AND CONTINUE OUR WORK**

TRENDING│ FOCUS│ SERVICES│ ABOUT US│ CONTACT

|