NEWS

AUSSIE WINE EXPORTS TO CHINA RECOVERED TO PRE-TARIFF VALUE AT AUD1.03B

By Siulan Law Mathews DipWSET

5-5-2025

Source: Wine Australia

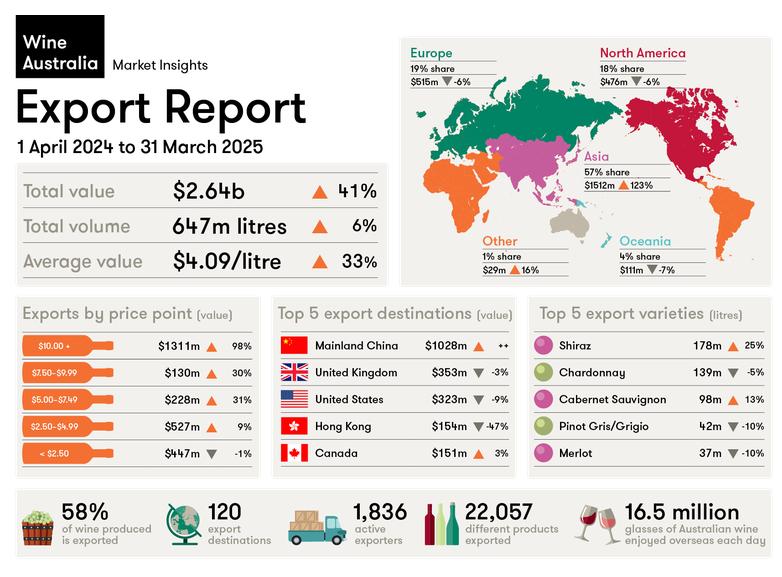

Australia wine exports to China reached AUD 1.03 billion (USD663 million) by value and 96 million litres by volume between April 2024 and March 2025, according to Wine Australia’s latest export report.

This latest export report is especially significant as it represents a full year since tariffs on Australian wine imports into China were lifted, it showed that the trade has almost fully recovered to pre-tariff value in just one year.

Total Australian wine exports increased 41 percent by value and 6 percent by volume in the year up to 31 March.

On top of this, the average value of exports reached its highest level in almost two decades, increasing 33 percent to AUD4.09 per litre.

This increase in average value has occurred almost entirely as a result of “elevated level of premium wine shipments to mainland China, after tariffs on Australian bottled wine were removed,” Peter Bailey, Wine Australia’s Manager for Market Insights, explains.

Source: Wine Australia

Peter Bailey continues: “While the total value of shipments to mainland China is now at a similar level to the years immediately before tariffs on Australian bottled wine came into force, volume in the last 12 months is 23 per cent smaller than the five year average between 2016 and 2020 and 44 per cent below the peak in 2018."

This, combined with a 13 percent decline in Australian wine exports to all locations other than mainland China, highlights a challenging path ahead for Australia’s wine industry, which is facing reduced consumption due to challenges such as demographic shifts, economic pressures and moderation trends.

As a result, Australian wine exports to the rest of the world barred China were at a 10-year value low and 20-year volume low, driven mostly by decreases in Hong Kong as sales transitioned to mainland China, followed by declines in the UK, USA, and Canada.

Furthermore, growth in China was almost entirely driven by premium-priced wine, with imports averaging AUD23 per litre. This means that the mainland China market is unlikely to present a solution to Australia’s wine stock issues.

According to Wine Australia, global uncertainties associated with tariffs announced by USA President Donald Trump are at the epicentre of market uncertainties moving forwards.

In the 12 months ended March 2025, Australian wine exports to the USA declined by 17 percent in volume.

The top five export destinations for Australian wine by value in the 12 months to 31 March 2025 were:

• Mainland China (up AUD1.01 billion to AUD1.03 billion)

• UK (down AUD12 million to AUD353 million)

• USA (down AUD32 million to AUD323 million)

• Hong Kong (down AUD136 million to AUD154 million), and

• Canada (up AUD3.8 million to AUD151 million)

The top five destinations by volume were:

• UK (down 19 million litres to 208 million litres)

• US (down 21 million litres to 106 million litres)

• Mainland China (up 94 million litres to 96 million litres)

• Canada (down 14 million litres to 60 million litres), and

• New Zealand (down 3.5 million litres to 26 million litres).

(the writer can be contacted at: info@thewinechronicle.com)

ALL RIGHTS RESERVED

**IF YOU THINK THE WINE CHRONICLE IS WORTH SUPPORTING, PLEASE MAKE A DONATION TO HELP US IMPROVE AND CONTINUE OUR WORK**

TRENDING│ FOCUS│ MISSION│ ABOUT US│ CONTACT

|